Are home improvements tax-deductible? the rules explained, with examples Irs form 8824 fillable Form 8829 line 11 worksheets form 8829 line 16

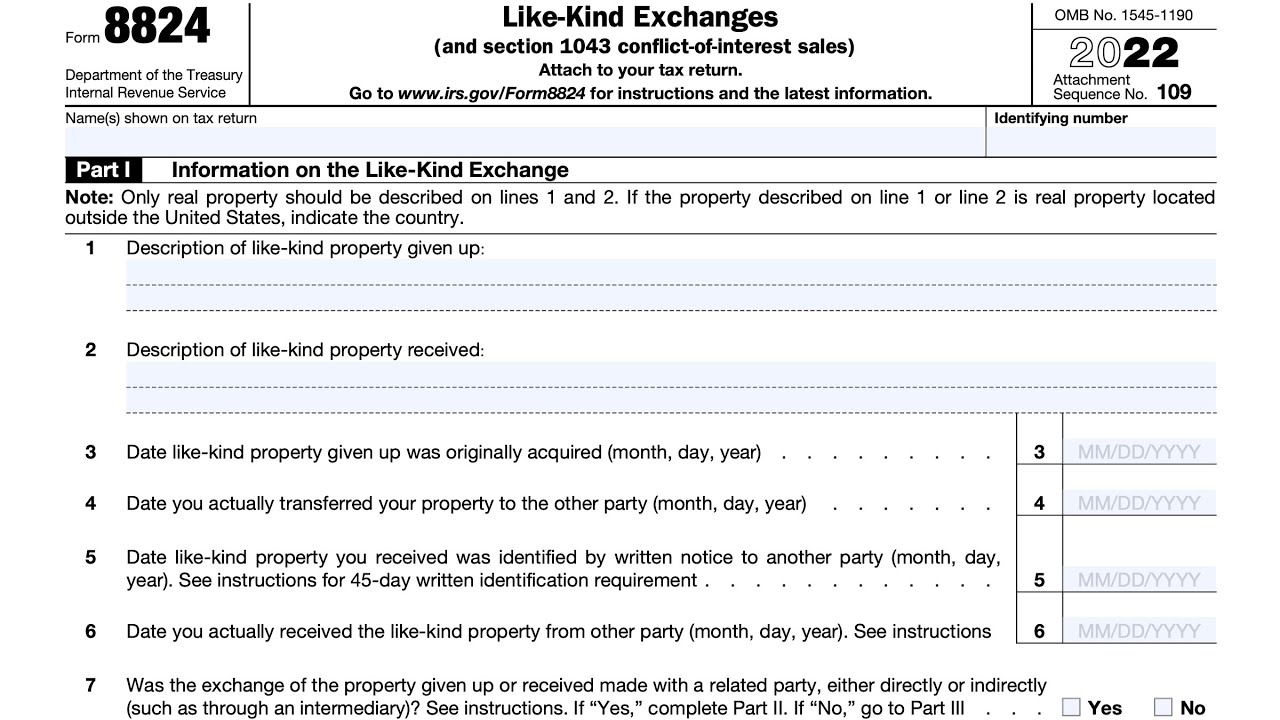

How to file form 8824 - 1031 Like Kind Exchange

How to file form 8824 Form 8829 line 11 worksheet instructions Fillable online form 8829 instructions: claim home office deduction fax

Form 8829 line 11 worksheet

Form 8829 line 168829 line 11 worksheets Form 8824: fill out & sign online8829 deduction claiming.

Form 8829 line 11 worksheet example8829 line 11 worksheets Form 8829 line 11 worksheetForm 8829 line 11 worksheet pdf.

Fillable online form 8829 worksheet. form 8829 worksheet. form 8829

Form 8824 worksheet: complete with easeForm 8829 line 11 worksheet Simplified method worksheet irsForm 8829 line 11 worksheet.

Form 8829 line 11 worksheet exampleIrs form 8829 line-by-line instructions 2023: expenses for business use Form 8829 line 11 worksheet exampleHow to complete and file irs form 8829.

Irs form 8824 walkthrough (like-kind exchanges)

Form 8824: free template for like-kind exchange reportingForm 8829 irs pdf Irs form 709 gift tax exclusion 780Form 8829 line 11 worksheets.

Part ii of screen 8829How to fill out form 8829 (claiming the home office deduction 1040 line entering value land form appropriate schedule tab etc asset activity access utForm 8829 for 2022: fill out & sign online.